Last week, Richard Griffin, financial advisor and CEO of Rickstar Financial gave a few seminars for the local community to learn about investing, the stock market, and different ways to build wealth in Aruba.

The free seminars, hosted by realtor Vicky Wesseling from Vickstar Realty, were intended to empower the local community with the knowledge they need to not be left out of opportunities in the financial market. Richard Griffin is the president and CEO of Rickstar Financial, a stock trading and wealth planning company based in Michigan, USA. Rickstar Financial LLC has a variety of clients, ranging from the beginning investor to celebrities and professional sports stars. The idea behind the seminars was to teach the local community on how to find an alternative to bank savings and real estate as the only way to legally and successfully grow their money.

“Ever since Covid, Richard has been talking about starting a Rickstar Financial branch here in Aruba,” Wesseling told our reporter. “Because I’m from the real estate side, he can also see the story of how difficult it is for locals. At this moment, when you have a really good job, with a nice income, you still cannot get a mortgage. Or the mortgage is super low, and with that little bit of money, with the market this high, you just cannot buy a home. So where do starters go?” she explained.

Wesseling says that the way Aruba used to be, back in the day, people lived with their parents to save money, got your plot of land from the government, and then slowly started building their house.

“By the time you finish, you finally say bye to your mom and dad, and you move into your own house. But that’s not happening anymore,” she says. To start, land is becoming scarce. Initially, Arubans could apply to get a plot of land from the government on which to build their house, and a mortgage from FCCA – Houses for the Aruban Community foundation. However, as the population continues to grow and more land is also dedicated to commercial development and a small portion to nature conservation, this is no longer an option for most of the next generations. “And prices have just been going up so high, even on long-lease land, the market value makes it impossible for locals to buy.”

This, combined with the heavy hit from the Covid pandemic, made Wesseling and Griffin realize that Arubans need another way of creating personal wealth for individuals. Wesseling says that Griffin started researching reasons why there are no other financial advisors that can manage accounts for locals to invest in the stock market from Aruba itself. And here they realize that the local community lacks the necessary information to know how to create and managing their wealth. “You don’t know what you don’t know”, she says. The lack of access to the stock market means that Arubans need to find ways to cope with inflation and lower salaries after Covid. “I have friends who are teachers and still are not receiving their full salary from before the pandemic”, Wesseling says. “They had to find a second job.” This also puts pressure on retirement plans for Arubans, leaving them with little options. “First thing you need is to invest in real estate, but to do that, you need cash or a mortgage.”

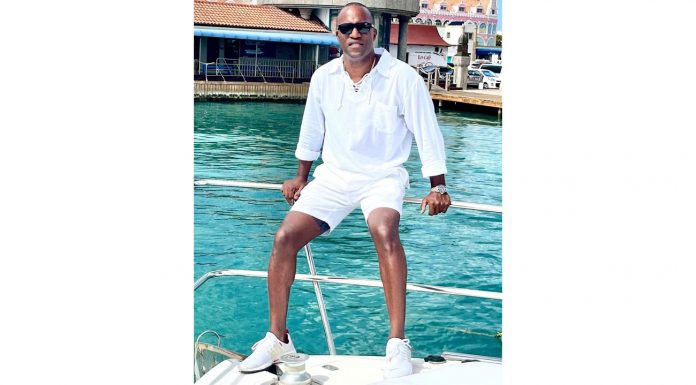

Griffin first came to Aruba as a sponsor for the Soul Beach Music Festival. “It was six years ago, and I fell in love. I fell in love with an Aruban woman, we bought a home, we have a family and we’re here now,” he said. “So I love the island, I’m part of the community. I even got the Aruban haircut!” he joked.

Our reporter asked when and how he noticed that there was a need in Aruba for this kind of financial literacy. “People started wondering what I did. They got word of what I do.” He said that he brings his celebrity clients to Aruba for a fun-filled trip, and this made the locals realize that he helps them with investment advice, and were asking if he could do the same for them. So he had the idea to open an office here.

“We’ve opened an office before. We have different regulations and hurdles we have to go over, but all in all, it’s still the same”, Griffin says. “You have to be clean-cut, you have to play by the rules, and the powers that be have to understand why and how.”

He said he decided to do the seminars to start helping people so they become more aware on how to create their own wealth. “That’s the real reason we do it. We don’t charge, they’re free, we pay for the venue, we pay for the food. But we’re doing this to teach people the basics of investing. Before they even begin to invest, we want to teach them, want to get them aware of what’s out there.”

He added: “And I think that’s the right way to do it, instead of opening an office, have people come in, and make a mistake with their hard-earned money.”

Griffin explained that the Central Bank of Aruba doesn’t have the regulations and permission for Arubans to invest in the stock market. The reason he decided to open a branch of his American company instead of opening a local company, he said, is that the American market has stricter rules and regulations, and is therefore more controlled and safer. He is currently working with the Central Bank of Aruba to open the door for the local community to be able to invest in the stock market.

Griffin is planning more seminars for the general population for next year. The idea is to empower people with knowledge so they can begin planning to take control of their wealth.