Today the Centrale Bank van Aruba (CBA) published the State of the Economy for the first quarter of 2022. This publication provides a synopsis of this period’s local and international economic developments. The domestic highlights are presented below, including a summary of leading economic indicators.

During the first quarter of 2022, the economy of Aruba grew by an estimated 16.2 percent, when compared to the corresponding quarter of 2021. This expansion was mainly spurred by a strong rebound in the tourism sector. Aruba’s year-on-year real GDP (Gross Domestic Product) growth has mainted its upward trajectory since the second quarter of 2021.

The surge in tourism activities was reflected in a jump in total stay-over visitors and total visitor nights, leading to buoyant developments in the tourism services sector and total tourism revenue. Aruba received a total of 233,666 visitors, an increase of 108.0 percent compared to the first quarter of 2021. Total visitor nights almost doubled compared to the first quarter of 2021, reaching 1,828,141 nights. The higher hotel occupancy rate of 62.2 percent and a spike in the average daily rate to US$ 355.30 led to a significant increase of 161.7 percent in the revenue per available room during the first quarter of 2022. Over the same period, total tourism revenue – as measured by tourism credits and registered in the Balance of Payments – soared by 92.0 percent to Afl. 874.8 million.

Commensurately, consumption-related indicators also improved, reflecting the continued economic recovery. During the first quarter of 2022, almost all consumption-related indicators showed improvement compared to the same period of 2021, signifying a continued economic recovery. Revenue from turnover taxes (+33.3 percent) and taxes on commodities (+30.4 percent), total value of merchandise imports (+40.3 percent), and the number of I-Pago transactions (+41.6 percent) surged in response to the increased demand brought on by the buoyant tourism performance. Furthermore, household water consumption and employment showed accelerated growth, while household electricity consumption rebounded.

Alternatively, credit market developments pointed to sluggish consumption demand, as witnessed in the respective drop of 3.6 percent and 6.5 percent in personal loans and car loans. The Consumer Confidence Index echoed the contractions witnessed in total outstanding consumer credit, as consumers were slightly more pessimistic in the first quarter of 2022 compared to the same period of 2021.

Inflation in Aruba is trending upwards

Albeit at a relatively slower pace, inflation in Aruba has been trending upwards since the beginning of 2021. Compared to March 2021, the end of period inflation stood at 4.0 percent at the end of March 2022. When measured as the percentage change in the 12-month average of the CPI (Consumer Price Index), inflation reached 2.1 percent at the end of March 2022. The real exchange rate of the Aruban florin vis-à-vis the U.S. dollar continued on a downward trajectory in the first quarter of 2022, thereby improving the competitive position of Aruba compared to the United States. This improved competitive position resulted mainly from the consumer prices in the United States rising faster than those in Aruba. In March 2022, the 12-month average inflation in the United States amounted to 6.2 percent, against a 2.1 percent increase in Aruba.

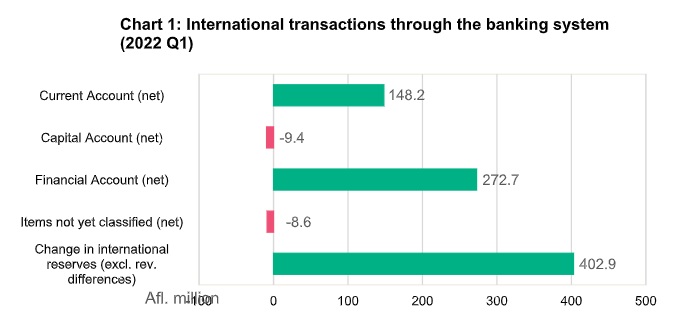

International transactions resulted in a large inflow of foreign exchange

International transactions settled through the commercial banks resulted in a significant net inflow of foreign exchange of Afl. 402.9 million during the first three months of 2022, pushing international reserves to Afl. 3,287.8 million. Both the current and the financial accounts of the balance of payments were positively impacted, recording on balance a net inflow of Afl. 272.7 million in foreign exchange (2021 Q1: Afl. 92.3 million surplus).

The inflows on the financial account during the first quarter of 2022 stemmed mainly from a loan received from the Netherlands (registered as ‘other investment’ in the Balance of Payments) to the Government of Aruba (GoA), in order to repay its maturing external debt in 2022 as part of an agreement with the Government of the Netherlands. The subcomponent ‘other investment’ resulted in a net inflow of Afl. 292.6 million in the period under review, which was partially offset by portfolio investment (net outflow of Afl. 40.9 million associated with outgoing payments in connection with government bond repayments) and foreign accounts (a net outflow of Afl. 38.6 million).

The government financial deficit narrowed, yet the government debt expanded

In the first quarter of 2022, based upon available information, the government financial operations led to the financial deficit narrowing to Afl. 52.0 million from Afl. 162.7 million. Total government revenue increased by Afl. 48.2 million, reaching Afl. 271.2 million at the end of the first quarter of 2022. However, total revenue still remained below the 2019.

First-quarter level (-10.4 percent). During the period under review, total government expenditure contracted by Afl. 63.5 million to Afl. 319.7 million, mainly because of contraction in transfers and subsidies and in transfers to General Health Insurance (AZV).

At the end of the first quarter of 2022, the government debt rose by Afl. 360.2 million, reaching Afl. 6,015.8 million, representing a growth of 6.4 percent when compared to compared to December 2021. An expansion of Afl 336.9 million in foreign debt and an enlargement of Afl. 23.3 million in domestic debt caused the increase in debt. The developments in government debt resulted in an estimated debt-to-GDP ratio of 103.3 percent at the end of the first quarter of 2022. Thus, although the liquidity support from the Netherlands facilitated short-term government financial operations and obligations, these additional loans further exacerbated the government’s limited fiscal space.