Today the Centrale Bank van Aruba (CBA) published the State of the Economy for the fourth quarter of 2021. This publication provides a synopsis of the local and international economic developments of this period. The domestic highlights are presented below.

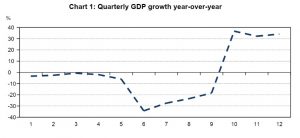

Strong rebound of the Aruban economy during 2021

During 2021, the Aruban economy grew by an estimated 17.9 percent, after contracting by 22.3 percent in 2020. On the output level, however, economic activities in 2021 remained below that of 2019. The aforementioned growth was driven mainly by the strong recovery in stay-over visitors and their spending. Another key driver of growth was domestic consumption, which was sustained by government support measures, such as the Emergency Social Assistance Fund (FASE), as well as the wage subsidy program. While the estimated GDP for the first quarter of 2021 declined, the following quarters of 2021 showed signs of robust rebound compared to the year before, rising more than 30 percent in each subsequent quarter.

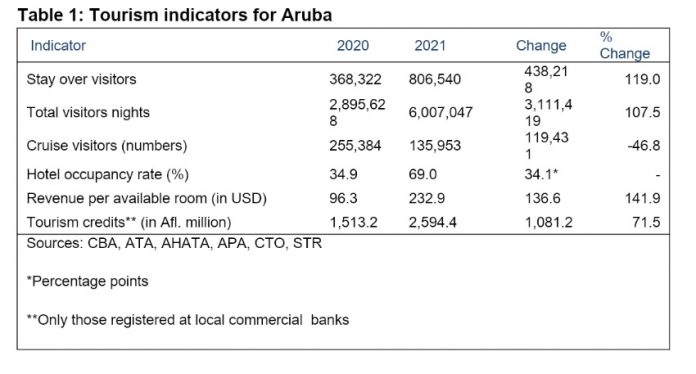

Tourism performed well in 2021, but remained below pre-pandemic levels

Stay-over arrivals regained growth in 2021, but did not reach pre-pandemic levels. In 2021, numbers of stay-over visitors strenghtened by 72.1 percent in 2019 terms. Total visitor nights in 2021 more than doubled compared to 2020 (Table 1). Revenue per available room surged by 141.9 percent in 2021 compared to 2020, pushed up by the higher hotel occupancy rate in 2021. The hotel occupancy rate practically increased twofold from 34.9 percent in 2020 to 69.0 percent in 2021. Tourism credits jumped by 71.5 percent in 2021 compared to 2020, reaching a level of Afl. 2,594.4 million at the end of 2021. Cruise tourism to Aruba in 2021, however, significantly lagged behind the low performance displayed in 2020, as the first cruise ship to arrive in Aruba docked on June 9, 2021.

Financial deficit narrowed in 2021, while government debt expanded

On the fiscal side, the financial deficit for 2021 (Afl. 475.2 million) narrowed compared to 2020 (Afl. 813.6 million). This relatively smaller deficit was a reflection of the economic recovery gaining momentum as of the second quarter of 2021. While government revenues inched up in 2021 compared to 2020, the government expenditures declined by 16.9 percent in 2021 compared to the previous year.

Government debt expanded by Afl. 506.8 million to Afl. 5,652.5 million at the end of 2021 compared to December 2020, as the debt burden continued to grow due to the COVID-19 pandemic. The share of foreign government debt in 2021 continued its steady ascent to 62.7 percent of total debt. The share of foreign government debt rose continuously as of the second quarter of 2020, when the government of Aruba began receiving short-term loans from the Netherlands as liquidity support. The estimated debt-to-GDP ratio stood at 108.7 percent at the end of 2021, down from 114.9 percent in 2020.

Inflation in Aruba is trending up

Higher gasoline prices on the international market caused inflation to trend up during 2021. At the end of the fourth quarter of 2021, the end-of-period inflation in Aruba rose by 3.6 percent compared to the fourth quarter of 2020 (Chart 2). The end-of-period inflation started to flare up as of December 2020. The 12-month average inflation rate, on the rise since May 2021, reached 0.7 percent at the end of December 2021. Nonetheless, consumer prices in the USA rose faster than those in Aruba, particularly due to the fact that utility prices stayed unchanged, creating an improved competitive position for Aruba compared to the United States of America.

International and official reserves remained adequate conform the monitored benchmarks

The level of international and official reserves was again adequate in 2021, according to the benchmarks monitored by the CBA. International reserves (incl. revaluation differences) grew to Afl. 3,130.6million in 2021 (+Afl. 776.8 million) compared to end-2020 (Chart 3). The main contributors of the gain in international reserves throughout 2021 were the short-term loans that were provided by the Dutch government to the Government of Aruba to cover its large liquidity needs. These loans were complemented by recovered foreign exchange inflows related to tourism services.

The complete publication is available on the CBA’s website (https://www.cbaruba.org/document/state-of-the-economy).