During its meeting of December 14, 2020 and after reviewing the most recent economic and monetary data, the Monetary Policy Committee (MPC)[1] of the Centrale Bank van Aruba (CBA) decided to keep the reserve requirement at 7.0 percent. The reserve requirement refers to the minimum amount of reserves that commercial banks must hold at the CBA and is equal to 7.0 percent of their liabilities with a maturity less than 2 years. The following information and analysis were considered in reaching this decision.

International reserves

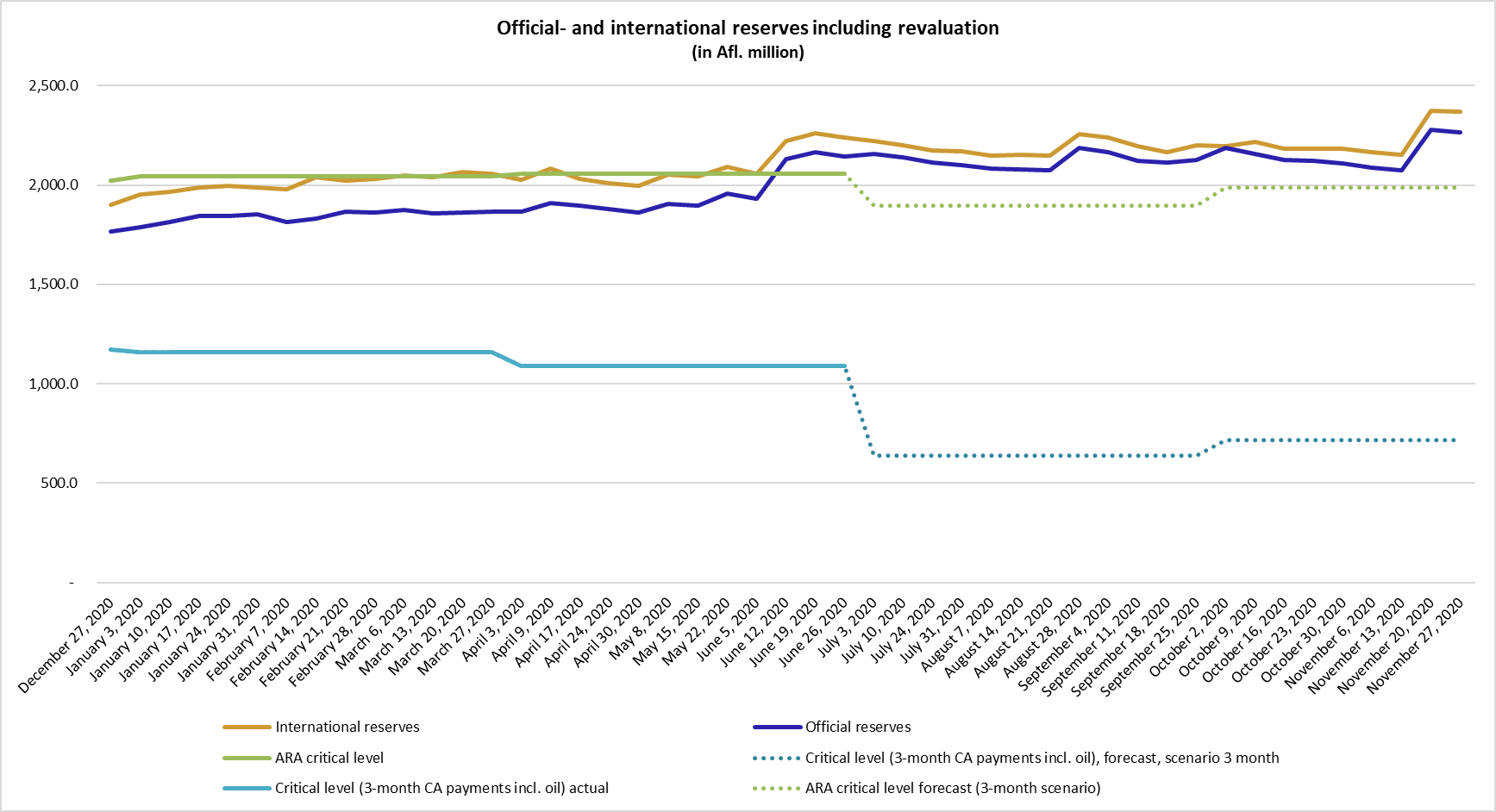

International reserves (including revaluation differences of gold and foreign exchange holdings), up to and including November 27, 2020, strengthened by Afl. 467.9 million compared to the end of December 2019. This expansion was the result of a sharp drop in imports due to reduced tourist and domestic demand, external financing received by the government, the foreign exchange measures taken by the CBA, and a revaluation of the gold holdings of the CBA following an increase in the market price of gold on the international market. Official reserves increased by Afl. 502.3 million. Consequently, the official and international reserves grew to, respectively, Afl. 2,267.0 million and Afl. 2,367.4 million as of November 27, 2020. Accordingly, the level of reserves remained adequate when benchmarked against the current account import payments and the ARA[2] metric by the IMF (Figure 1). At the end of November 2020, international reserves covered 10.0 months of current account payments, while official reserves equaled 106.6 percent of the ARA metric.

Figure 1: Reserves

Credit developments

In October 2020, total credit declined by Afl. 10.5 million or 0.3 percent, when compared to the end of 2019. This was mainly driven by the category ‘other’, which recorded a contraction of Afl. 56.0 million (-9.8 percent), as government bonds held by the commercial banks expired. Contrarily, the component ‘loans to individuals’ contributed positively to total credit (+Afl. 29.8 million/+1.6 percent), pushed up by housing mortgages. The category ‘business loans’ also increased by Afl. 15.7 million (+1.0 percent), the result of higher demand for term loans above two years.

Inflation

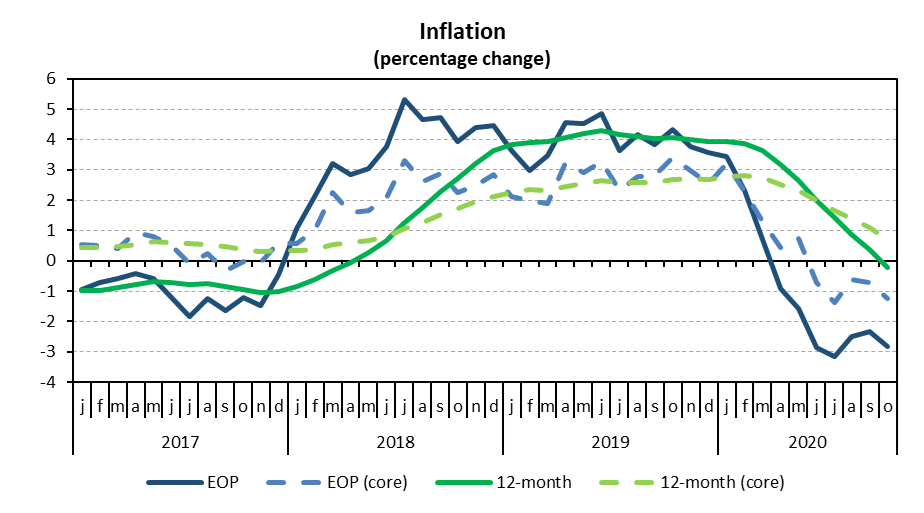

The CPI was 2.8 percent lower in October 2020, compared to the corresponding month a year earlier (Figure 2). This was mainly attributed to lower prices for gasoline and a reduction in electricity tariffs. The 12-month average inflation rate reached -0.2 percent in October 2020, down from the peak of 4.3 percent reached in June 2019. The 12-month average inflation is expected to further decrease during the remaining months of the year, due mainly to the aforementioned reduced electricity tariffs as of January 1, 2020. When excluding energy and food, the 12-month average core inflation rate stood at 0.7 percent in October 2020.

Figure 2: Inflation

Prudential liquidity

The prudential liquidity of commercial banks (32.0 percent), which measures the amount of their liquid assets to their total net assets, remained at a comfortable level, far above the minimum required prudential liquidity ratio (15.0 percent).

Source: Centrale Bank van Aruba