In line with the Monetary Policy Committee’s (MPC) task to evaluate, determine, and provide transparency on the monetary policy actions of the Central Bank of Aruba (CBA), the CBA communicates the following. During its meeting on October 12, 2022, the MPC decided to keep the reserve requirement at 24.0 percent as of November 1, 2022. Accordingly, commercial banks must hold a minimum balance at the CBA equal to 24.0 percent of their clients’ short-term deposits. The decision to maintain the reserve requirement at 24.0 percent was based mainly on the downward trend in the commercial banks’ excess liquidity, as well as the persisting adequate level of foreign exchange reserves.

The MPC considered the following information and analysis during its deliberation:

International and official reserves

The international reserves, comprising the official reserves of the CBA and foreign reserves held by the commercial banks, widened by Afl. 140.3 million (Graph 1) on September 23, 2022, compared to end-December 2021. Official reserves rose by Afl. 64.6 million, while the foreign reserves held by the commercial banks grew by Afl. 75.7 million. Consequently, on September 23, 2022, the official and international reserves stood at Afl. 2,809.5 million and Afl. 3,269.9 million, respectively. For the rest of 2022, the CBA expects strengthened official and international reserves due to increased foreign exchange inflows from tourism and a pick-up in foreign direct investments.

Maintaining reserve adequacy is critical to keeping the fixed exchange rate between the Aruban florin and the US dollar. To this end, the CBA anticipates international reserves to remain comfortably above the minimum required three months of current account payments. The latter consisting of, among others, consist of import payments, interest payments made to investors, and foreign transfers such as money remittances by foreign workers. Official reserves are forecasted to stay within an adequate range when benchmarked against the International Monetary Fund’s (IMF) Assessing Reserve Adequacy (ARA) metric (Table 1).

Inflation

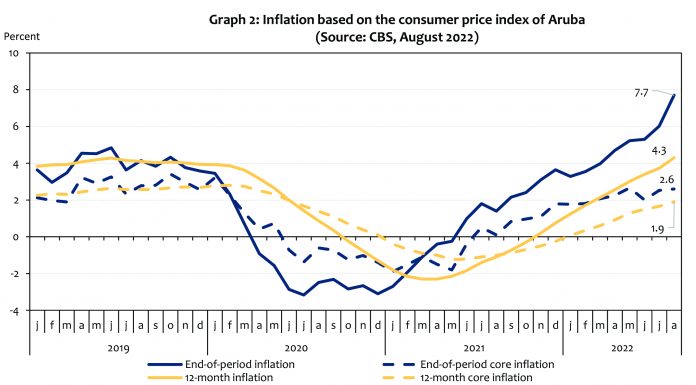

In August 2022, the consumer price index (CPI) rose by 7.7 percent compared to the same month a year earlier (Graph 2). Compared to a year earlier, the jump in the CPI was caused by higher utility prices, which affected the ‘housing’ component (2.6 percentage points contribution). Moreover, a surge in gasoline prices influenced the ‘transport’ component (2.4 percentage points contribution). Other notable increases were recorded in the categories ‘food and non-alcoholic beverages’ (1.3 percentage points contribution), and ‘household operations’ (0.8 percentage point contribution).

The 12-month average inflation climbed to 4.3 percent, and the CBA expects increasing inflationary pressures for the remainder of 2022. This expectation follows from the elevated oil price on international markets, as well as the recent hikes in utility tariffs. Furthermore, the expectation is that Aruba will import much of the soaring prices from its export partners, particularly the United States and Europe.

Meanwhile, in August 2022, core inflation (excluding energy and food) reached 2.6 percent on a year-over-year basis. The year-over-year core inflation was driven mainly by the ‘transport’ (1.0 percentage point contribution) and ‘household operations’ (0.8 percentage point contribution) components. On a twelve-month average basis, core inflation amounted to 1.9 percent.

Commercial bank excess liquidity

Aggregated excess liquidity fell from Afl. 1,320.5 million in December 2021 to Afl. 800.7 million in August 2022 (Graph 3). This drop in excess liquidity was principally due to the consecutive hikes in the reserve requirement from January 2022 to July 2022. In August 2022, excess liquidity contracted further. Nevertheless, excess liquidity remained above the pre-pandemic levels of February 2020 (+Afl. 111.6 million). The heightened level of excess liquidity results from ample liquid deposits at commercial banks, exacerbated by the subdued credit expansion. Ample liquid deposits likely relate to the recovery in the tourism sector. However, the expectation is that the Government of Aruba will finance its budgeting deficit locally. In addition, loans related to the hotel sector will probably pick up in the remainder of 2022. Both circumstances entail a downward pressure on the commercial banks’ excess liquidity.

Centrale Bank van Aruba

November 28, 2022