(Oranjestad)—Today, the Centrale Bank van Aruba (CBA) published the State of the Economy report for the third quarter of 2022. The publication contains national, as well as international economic developments. The highlights of this publication are presented below.

In the first nine months of 2022, the Aruban economy grew by 12.1 percent compared to the same period in 2021. A strong tourism performance in terms of stay-over visitors and tourism expenditures mainly drove the registered growth in real GDP. Moreover, observed consumption and investment indicators painted a primarily positive picture, thereby contributing to economic activity.

The tourism industry in Aruba registered upturns in stay-over visitors (+44.0 percent) and visitor nights (+40.9 percent) in the first three quarters of 2022. Compared to 2019, total stay-over visitors recovered by 96.2 percent (YTD Q3 2022 vs. YTD Q3 2019) and total visitor nights by 94.5 percent (YTD Q3 2022 vs. YTD Q3 2019). The surge in stay-over visitors, due in large part to an expansion in the U.S. market, was evident in hotel performance (Table 1.). Higher tourism demand drove up hotel occupancy and the average daily rate, leading to improved RevPAR and increased total tourism revenue (registered at commercial banks). Data on “other accommodations” also showed a positive development during the first nine months of 2022, registering more extensive growth than that of high-rise hotels, low-rise hotels, and timeshares. The gradual recovery of cruise visitors also contributed to tourism performance in the period under review.

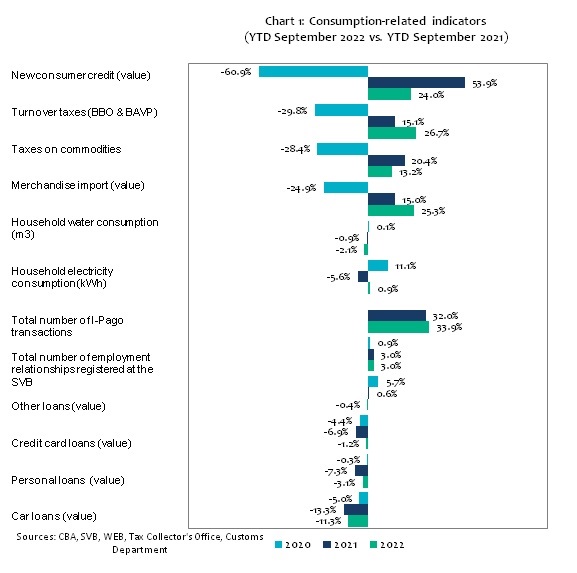

Consumption-related indicators painted a mostly positive picture of the first nine months of 2022, compared to the same period of the previous year (Chart 1). Turnover taxes (BBO & BAVP) and taxes on commodities recorded an increase. Compared to the same period in 2019, turnover taxes (BBO & BAVP) expanded, while taxes on commodities lagged. The positive development in turnover taxes and taxes on commodities, compared to the same period of the previous year, reflected the continued strong performance of the tourism sector, the related boost to domestic consumption, and the higher prices of goods and services. The latter developments, in turn, led to an expansion (+25.9 percent) of the trade deficit.

During the period under review, investment indicators improved; however, some gains were inflation induced. For example, the nominal import value of construction materials rose. Nonetheless, the import weight of construction materials (a proxy for real imports) contracted compared to the first nine months of 2021. Similarly, the growth in the import weight of base metals and derivated work, and the import weight of machinery and electrical equipment, were smaller than the expansion in their nominal import values. On the other hand, in the first three quarters of 2022, new commercial and housing mortgages surged compared to the first three quarters of 2021.

At the end of September 2022, the consumer price index (CPI) stood at 106.2, a hike of 7.0 percent compared to the same period in 2021.

Increases in the housing and transport components and the continued expansion in the food and nonalcoholic beverages component mostly fueled the uptick in the CPI. The end-of-period core inflation (excluding food and energy components) continued its rise to 2.4 percent compared to September 2021, pushed up in large part by the component purchase of vehicles, reflecting higher vehicle prices. Furthermore, continuing its upward trend, the 12-month average inflation rate reached 4.7 percent in September 2022. Higher gasoline and food prices were the main drivers of this increase. The 12-month average core inflation also rose to 2.0 percent. Nevertheless, the real exchange rate for the Aruban florin vis-à-vis the U.S. dollar trended downwards during the first three quarters of 2022. This downward trend results from consumer prices in the United States rising faster than those in Aruba.

International transactions settled through the banking sector resulted in a significant net foreign exchange inflow of Afl. 197.6 million in the first three quarters of 2022 (Table 2). Consequently, international reserves (excluding revaluation differences) climbed to Afl. 3,087.2 million at the end of September 2022. This outcome resulted from a net inflow of foreign exchange on the current account that outweighed recorded net outflows on the financial and capital accounts. The net foreign exchange inflow on the current account was mainly driven by the services account, particularly, tourism export services.

In the first nine months of 2022, government finance data revealed that the government’s financial deficit narrowed to Afl. 54.9 million from Afl. 459.3 million in the same period of 2021. This outturn resulted from a sharp decline in government expenditure and a jump in government revenues. This significant improvement in government finance stemmed from improved economic performance related to the continued strong recovery of the tourism sector and the absence of social and business assistance programs in place during 2020 and 2021. All tax components, with the exception of taxes on income and profits, showed advancement compared to their respective 2019 levels.

At the end of September 2022, government debt expanded by Afl. 161.1 million to Afl. 5,816.7 million compared to December 2021. This expansion resulted largely from loans received by the Government of Aruba (GoA) from the Netherlands to repay external debt and for its liquidity needs. At the end of the period under review, economic growth led to a decline in the estimated debt-to-GDP bringing it down to 91.2 percent from 101.0 percent at the end of 2021.

The complete publication is available on the CBA’s website. (https://www.cbaruba.org/document/state-of-the-economy).